Personalization in Financial Services: Types and Examples

Learn how Regions Bank Perfected their customer journey

Today’s financial services marketers are facing new demands. They don’t just need to stay current with new marketing trends in the financial services industry, they need to stay on top of new finance and marketing technology to give consumers what they demand, and capture more market share.

Banks and other financial services institutions have been slow to join the personalization era, and many are now attempting to catch up as they realize that this marketing concept is not a passing trend. Additionally, as data privacy concerns shift, new technology is emerging that is designed to help organizations gather customer insights while maintaining privacy. Now is the time for marketers in the financial services industry to lay the groundwork for a unified customer experience that takes more nuanced factors into consideration when making recommendations to customers. Let’s take a look at the different ways that organizations can implement personalization in banking:

What is Personalization in Banking?

Personalization in banking is about delivering a valuable service or product to a customer based on personal experiences and historical customer data. It can help to build trust and in turn, drive results and revenue. By creating an end-to-end experience that integrates customer and operational data across all branches, apps and call centers. In short, personalization can help organizations deliver solutions to their customers before they even realize they have a problem.

Personalization in finance isn’t an all-new trend – it’s a re-imagining of the business models that brought consumers to banks before the era of mass marketing. Decades ago, consumers would visit banks where they knew tellers on a first-name basis, as they were all active members of the same community - Today’s world is much more fragmented.

What is the Benefit of Personalization in Financial Services?

In recent years, the financial services market became much more transactional – it was no longer about the relationships with bank tellers. Instead, consumers were more concerned with who doesn’t charge maintenance fees, and who has the best rewards system for their credit card.

In a race to cut costs, the personalized nature of financial services suffered. This is a huge missed opportunity. Today’s customers are looking for valuable insight and advice from their banks, however, it’s difficult to give good financial advice when you don’t know a customer’s goals or priorities, something many banks don’t have the capacity to offer.

In addition to improvements in revenue, personalization in banking can enable a number of benefits including:

- Increases in engagement and conversion rates

- Improved customer loyalty and retention

- Enhanced customer experience

- Consistent messaging across channels

- Stronger marketing ROI

For example, think of credit cards. Who doesn’t offer a credit card? Every bank, and most major retailers are all competing for customers with steady incomes, solid payment histories, and frequent credit card use. This has caused a saturated market where banks are forced to become increasingly competitive – causing them to tighten their margins, or take a gamble on customers with low FICO scores.

Not only that, but new entrants into the financial services industry have put the squeeze on existing companies. The most formidable new entrant is Amazon, with their Amazon Cash and Amazon Lending offerings that mirror prepaid debit cards and investment services. As of 2019, Amazon was lending over $1 billion per year, and has since promised to continue growing and capitalizing on market share that once belonged to traditional financial service organizations.

As a result of this competitive environment, financial services companies have started to build value by competing based on customer experience. By connecting with customers in a personalized, relevant way, banks can move away from the product-obsession that sacrifices their margins, and towards a customer-centric focus that builds their brand value.

Types of Personalization that Banking and Financial Services Teams Can Offer

Generally speaking, there are 3 overarching types of personalization that banks and other financial services institutions can employ:

Prescriptive Personalization: The goal of prescriptive personalization is to anticipate a customer’s wants and needs based on historical data. Working within the context of the business’s goals, marketers can use this method to create rules and workflows that allow them to more easily manage users.

Real-Time Personalization: Real-time personalization relies on current, real-time data as well as historical data to create a personalized customer experience as it is happening. For example, marketing teams can leverage this type of personalization to make recommendations for customers as they are actively shopping on the site. This helps to drive both customer engagement and conversions.

Machine-Learning Personalization: This type of personalization makes use of intelligent machine-learning algorithms. With AI-driven automation, teams can make informed decisions about how to reach out to customers based on individual behavior.

Examples of How Banking Can Deliver Personalization

For the banking and financial services industry, creating personalized experiences will only become more important as customers increasingly come to expect a certain level of personalization in their shopping experiences - banks and financial institutions included.

If a customer walks into a physical branch location, they are going to expect an experience that takes their personal history into account. They don't just want to hear about the companies newest product or available service, they want to find solutions to their problems and they want to know how your business can help them meet their specific needs. Personalization enables this, allowing banks and other institutions to optimize the customer journey with catered recommendations.

Let’s take a look at 3 examples of the banking industry can deliver personalization for their customers:

1. Leverage Personalization Initiatives Across Channels

Personalization needs to use several sources of consumer information to create a three-dimensional view of a single consumer. As a result, unified marketing measurement is absolutely central to personalization initiatives.

Marketers must link data from multiple campaigns – and multiple parts of their organization – to create a cohesive narrative that spells out which personalized campaigns are successful, and which aren’t. This is key for customers that were either referred to the bank, or are part of a remarketing goal. Marketers need to find the trail that these consumers are following, and craft their next touchpoint based on previous touchpoints – whether they’re online or offline. For example, consider the following billboard for a credit union:

Image Credit: Intellithought

For best results, the creators of this billboard should direct potential customers to a special landing page that’s specifically relevant to people who want to purchase homes in the geographic area of this billboard. If a customer lands on their “/lockandshop” landing page as their first touchpoint, then all subsequent targeted messaging should involve homebuying, or local trends in finance.

This requires both online integration and offline media optimization technology. To fulfill this need, marketers often employ media planning software alongside their marketing analytics solution. This will help your financial services institution optimize all media placements and messages from a central location, no matter if they’re online or offline.

2. Create Personalized Blog Content

Data-driven content creation is becoming integral to marketing strategies, and the financial services industry is no exception. However, creating content isn’t as simple as making a few standardized resources for customers.

Content isn’t one-size-fits-all, even if some pieces appeal to wide demographics. Instead, try to optimize your blogs and resources based on small customer segments, and then advertise them to consumers that have the most interest in that content. Here are two primary ways to segment customers when creating targeted content:

- Dividing based on use – Is this particular consumer using your credit card? Or are they looking for home financing? Marketers need to identify which customers are using what products, and show them content that aligns with the products they value.

- Dividing based on interest – The average American wouldn’t be interested in a flight-miles credit card. However, somebody who travels often for work or leisure would be very interested in a credit card that offers flight miles. So, any promotional blog content for this credit card should be pointed towards frequent fliers. Financial services marketers need to leverage customer data to accurately identify the most responsive customer segments.

Targeting blog content this way can also help strengthen customer relationships. If you send email updates when your team posts to the blog, you can ensure that clients only receive content that is relevant to them. This will make your updates more personalized and show that your organization cares about your individual consumer’s interests.

To create content that resonates with consumers, it’s best to link attitudinal survey responses to person-level sales data. This will help your organization find weak areas where more content is needed in order to resonate with a specific demographic or target audience.

3. Segment Based on the Buying Cycle

Timing is everything. Financial services marketers shouldn’t promote products simply based on industry trends or sales quotas. Instead, use a marketing analytics platform to turn data from your CRM into a framework for smarter, more timely promotions.

First, marketers should identify which services customers are most likely to desire at each stage in the purchasing cycle. This information can be uncovered by analyzing person-level data with a marketing analytics platform. Then, these customers should be segmented based on their purchasing cycle. Here are a few suggestions:

- Awareness – At this point, consumers are learning more about your product offering. All outreach should focus on explaining how your product satisfies a need.

- Consideration – If a customer is interested in your product, they will usually see what your competitors offer before deciding. This is the time to explain what your service does differently, and provide customer testimonials.

- Decision – At this point, the customer is ready to make a purchase. They often just need a straightforward path to purchase, or perhaps a special offer to create a sense of urgency.

- Assessment of Choice – The buyer’s journey doesn’t end after they purchase, especially for service-based industries. The best financial institutions will regularly offer informative content to help people make the most of their offerings, and avoid losing them to competitors.

In essence, banks need to understand that a first-time visitor is different from a customer that’s researching, which is different from the needs of long-term customers. To encourage action, optimize your CTAs and content based on a consumer’s place in the purchasing cycle. For example, a first time customer should have a CTA button that says “How it Works” while a researching customer should see a button that says “Learn More.”

Marketing Attribution Methods for Financial Services

A personalized relationship builds trust. This used to be inherent in the financial services industry, as customers would visit physical branches and speak to friendly tellers directly. However, today’s consumers have shifted away from this face-to-face approach, opting instead to use ATMs, online banking – and even banks with very few brick-and-mortar physical locations. Unfortunately, banks have struggled to keep pace with these digital changes, and find it increasingly difficult to understand how modern consumers interact with banks and credit unions.

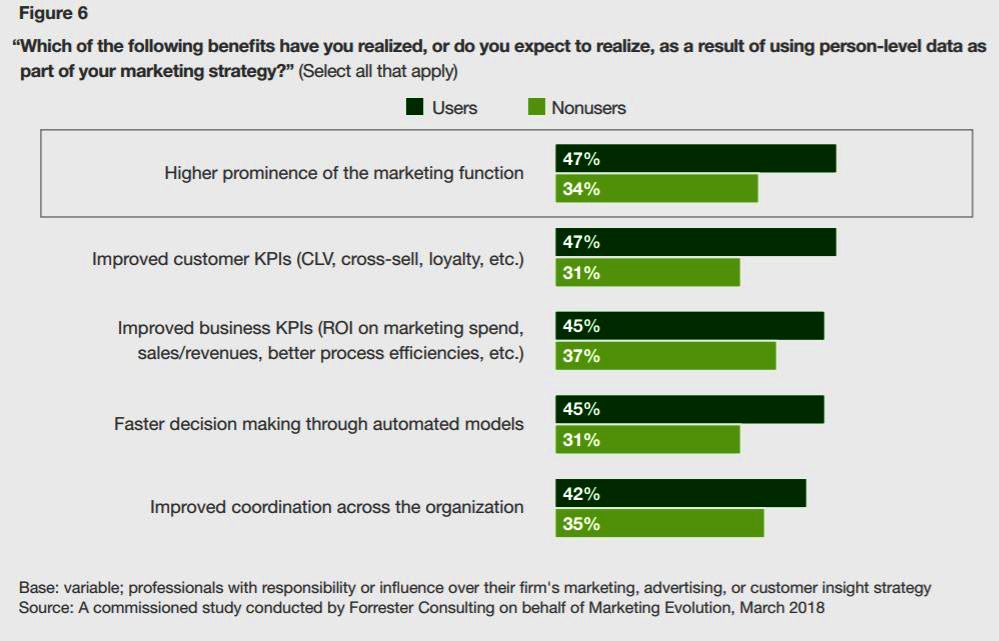

To understand how consumers interact with banks, it’s vital that financial services marketers leverage person-level data collected from both online and offline interactions. These insights will allow marketers to better understand purchase drivers, behaviors, attitudes, and where customers are in the buyer’s journey.

There are several measurement methods required to ensure marketing teams are capturing and properly leveraging all of this person-level data.

Media Mix Modeling

Media mix modeling (MMM) allows marketers to determine how certain facets of their marketing mix impact overall sales performance. This is found via analyses such as linear regression or multiple regression. As a result of this statistical analysis, marketers can find valuable insights into what influences key factors like sales volume, a channel’s impact on sales, and the overall marketing ROI.

However, media mix modeling has a firm set of limitations. It is best suited to measuring offline media, and marketers must wait weeks or months to receive high-level insights regarding campaign outcomes. This makes it hard to optimize campaigns at a detailed, person-level across all marketing channels.

Multi-Touch Attribution

While many banks use media mix modeling, in the 2000s, a new, digital form of measurement became popular – multi-touch attribution (MTA). This method evaluates digital marketing efforts from the bottom-up, and provides a more person-centric approach by evaluating every touchpoint an individual hits on their journey to purchase. Then, it determines which touchpoints, channels, and messages had the greatest impact on towards a desired outcome.

MTA allows marketers to view insights and adjust their media plan marketing tactics while a campaign is in flight, but it doesn’t allow organizations to evaluate content effectiveness and track a brand’s strength. Although MTA is more advanced than media mix modeling, it unfortunately has a strong bias towards digital touchpoints – leaving the impact of in-person interaction to be largely enigmatic.

Unified Marketing Measurement

Unified marketing measurement (UMM) combines multiple data sets, techniques, and approaches to accurately assign value to both online and offline touchpoints. With UMM, organizations can get an accurate view of purchase drivers, behaviors, and attitudes that influence a customer’s decisions – enabling marketers to optimize their messaging on an individual or microsegment level.

According to Forrester, implementing UMM can provide opportunities to improve the efficiency of marketing budgets by 15 to 20 percent. However, brands that use UMM for person-level optimization have seen up to a 30 percent improvement in budget efficiencies.

Final Thoughts

Consumers believe that financial services organizations provide necessary services that affect their future financial standing as individuals. Financial services marketers need to understand the perspective of the consumer, and offer them personalized, direct methods of marketing communication. By using the right technology, strategies, and insights, marketers in the financial services industry can enjoy increased loyalty from customers, and strong growth in market share.

Today’s banks aren’t just competing amongst each other – they’re competing against technological powerhouses that are harnessing data to their advantage. To keep pace with this changing environment, financial services institutions must revamp their approach towards campaign measurement to understand their customers at a person-level. With a personalized, people-based approach to marketing, financial services companies can reduce friction in the customer journey and achieve higher engagement.

As public concern and the number of regulatory mandates continue to increase, financial services organizations will need to consider solutions that can help deliver more personalized customer experiences while maintaining compliance and upholding public trust. With the proper measurement tool in place, organizations can shift their focus to the customer and remain competitive in the industry.